Binance and Terra - Investment Thesis UPDATE

A theory based on probable cause, PART 2

It has been awhile since I last communicated with my subscribers. This post is entirely piggy-backing off my first Binance Terra Investment thesis so please consider reading that first! Recently, I have been entirely focused on stable coins, I believe all industry leaders have spent their attention in that direction as well. There is no liquidity without custody services minting new coins and providing off and on-ramps, connecting the crypto world with fiat world. Right now, more than ever is simply the introduction of new trusts and new stables. There must be easy access for users to enter/exit into the space. Without fiat injection there is no liquidity, simple.

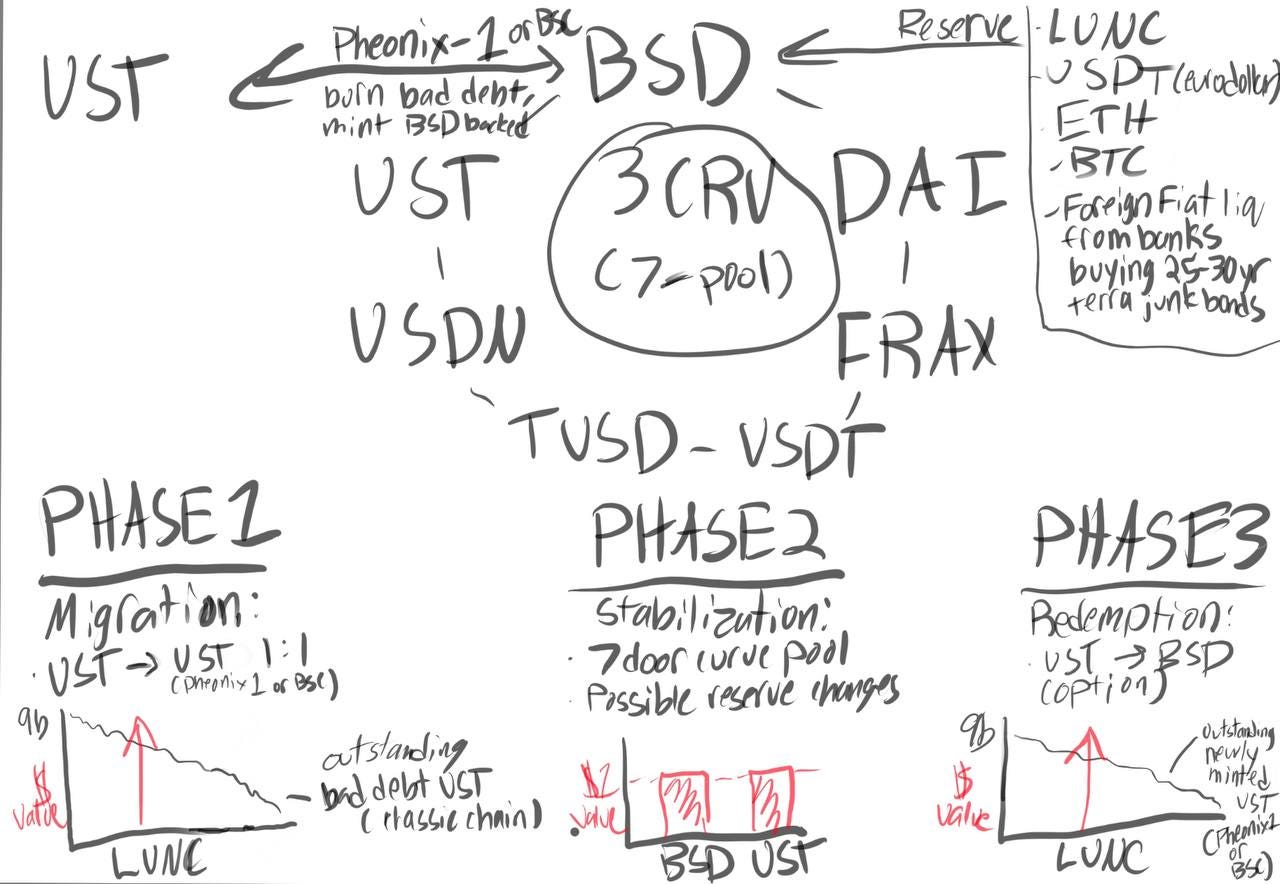

Now, enough macro picture. We want to be able to capitalize on these movements. A few months ago, I posted a blog that head of Binance, CZ is interested in reviving Terra, involving a re-peg of USTC, the de-pegged algo-stable coin. CZ claimed numerous times it was the right direction, however executed poorly. I have created a model based on public collected info, what I believe will be the steps taken to revive this dead stable coin. In this post I will discuss the relationship between Basis Dollar (BSD)/ Terra (UST), the steps taken to collateralize UST with BSD, and finally, profitability.

Focusing from the top right across to top left; there will be the introduction of the stable coin, Basis Dollar (BSD), a stable coin which failed in 2019. BSD is built based on the Bonding Curve method - stability through minting more into circulation, dilution of bad debt if <$1. While UST is seignorage- monetary policy, LUNA reserves used to peg UST, market making between the two < or > $1. In order for BSD to prosper there must be constant feed of stable coin reserves to mint more supply. Allowing a redemption option for UST into BSD will provide an incentive for UST holders to migrate.

Phase 1: Migration

As outlined above, there will be a movement out of the terra classic chain, as it cannot support new blockchain infrastructure due to lack of developers. Incentivized by the ability to redeem for a profit, UST will bridge to Binance Smart Chain or Terra Pheonix-1(new terra chain) via swap function. The bad debt left in classic chain will be burned and new UST stable coin will be minted on the newer chains.

Phase 2: Stabilization

After the migration of UST and newly minted UST collateralized by BSD, there will be a period of instability with BSD and UST due to LUNC profit takers. After the bad debt on the classic chain is cleared, and BSD is holding the weight on their shoulders, LUNC will prosper on a clean slate of no more UST classic to stabilize. There will be two methods to provide stability. First, the reserves for BSD and secondly, liquidity pool to be built on Curve Finance app. Reserves will be a combination of supply, as well as possibly proceeds from terra classic bond sales. Liquidity will come from a pool comprised of other stable coins. Recently, Binance acquired Curve DAO tokens, allowing them governance rights to adjust stable coin pools on Curve Finance. This will enhance swapping capabilities for the two coins using a large pool of other stable coins. This, along with reserves for BSD will help stabilize the value and protect against LUNC sellers.

Phase 3: Redemption

When UST and BSD have conquered the ruptures of market traders and remain stable, the new UST will be collateralized, so holders will have the ability to burn and exit their investment into BSD, or even reserves. This will continue until all conversions into collateral have taken place. Transaction volume will be a key indicator of when this window wanes. Most of the current holders will be short term, as they will exit for profit. We will see how much UST is left at the end.

Okay, we have covered pretty much everything. Now that we understand our investment we can prosper on exit strategies, because in the end, we are playing an investor role. UST redemption into BSD will be a 66x at current rates, currently trading at 1.5c. That is the maximum return as it caps off at $1, and will only be treated as a short-term trade; however, income investors- there will be lending options expected later on, paying high yields if you choose to remain in the position. LUNC will fluctuate more, because it will play two roles. The short-term trade will be prospered off cleared debt from the classic chain. After this, there will still be use for it, and no cap on the amount of return it bares. The long-term trade will be based on the minting supply of BSD, as it will play a reserve role, users will be continually transacting it in and out, TVL=capital appreciation. Long-term trade will also consider the typical seignorage role with newly minted UST, if we expect UST to make a comeback with utility to come. Expect more burning (hardening) of LUNC in the future, after bad debt is cleared.

Thanks and please consider subscribing! Any amount helps the cause. This post will close to paid subscribers after 7 days.