Scalability of Stable Coin USDX Through Flare’s Fasset Innovation

USDX has positioned itself well, as a liquidity provider for Fasset collateral as well as a multi-purpose tool in Flare ecosystem. As XRP liquidity has just onboarded, more opportunity awaits.

USDX, a stablecoin developed by HT Digital Assets, is pegged to the dollar and propped by delta neutral trading of perpetual contracts (much like Ethena USDe by Arthur Hayes), custodied by Hex Trust. By integrating with the Flare network, USDX leverages lending pools (hosted by Clearpool, partner to Hex Trust) and Flare’s Fassets to unlock scalable opportunities in DeFi. In this article I will explore USDX’s potential as a cornerstone of Flare’s Fasset ecosystem.

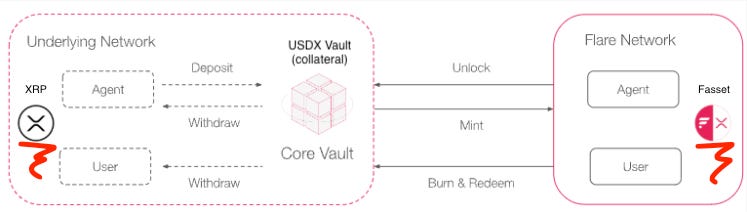

USDX will generate compelling yields on Flare by serving as collateral for incoming Fassets. Fassets are Flare’s mechanism for onboarding external liquidity from non-smart contract blockchains like BTC, XRP, and DOGE. These assets are wrapped as Fassets to enable DeFi functionality, requiring secure collateral to back their value. USDX allows anyone to provide trustless collateral without lockup periods, leveraging the T-pool, a liquidity pool via Clearpool. USDX is positioned to be the greatest risk-adjusted asset on the market. It’s integration with Fassets offers several advantages that enhance its scalability: interoperability, investor appeal, and inclusive of different asset rewards for users.

Fassets enable assets from outside blockchains to interact seamlessly within Flare’s DeFi ecosystem. Outside blockchains onboarded must be backed 1:1 to ensure counter party support. USDX’s role as collateral works perfectly for support and interoperability by providing a stable backing for Fassets: ((BTCfi and XRPfi(wrapped on Flare)). As more blockchains integrate with Flare, USDX’s utility as a collateral option grows, potentially positioning itself in the center of multi-chain liquidity.

Institutions are increasingly exploring DeFi for yield but are typically in search of low-risk, regulated assets. USDX’s sister USD0X will provide 1:1 T-bill backing for USDX, allowing USDX the same safety of USDT or USDC, but giving a higher return. This makes USDX a gateway for traditional finance to engage with DeFi securely. Flare’s ecosystem supports layered DeFi applications, and USDX’s collateral role extends beyond Fassets. For example, USDX can be used in lending protocols, yield aggregators, or derivative markets built on Flare. This amount of use case increases USDX’s liquidity and yield opportunities. Staking can compound rewards across protocols while maintaining that stable coin price stability. No other Treasury-backed stable coin offers comparable DeFi integration.

As Flare expands Fasset support to additional non-smart contract chains, USDX collateral providers can earn yield in Fasset supported products, like XRPfi or BTCfi. This diversification attracts new users to Flare, creating a growth cycle: more Fassets increase USDX demand, driving higher yields and network growth. USDX is a catalyst for Flare’s ecosystem expansion.

From a competitive standpoint, USDX works more than other stablecoins, providing it’s yield potential and DeFi integration. It’s price stability ensures safe collateralization, so long as Hex Trust maintains secure custody. Flare’s ability to distribute yields in the form of supported Fassets diversifies returns, allowing investors a dynamic capital allocation.

In conclusion, USDX’s synergy with Flare’s Fassets positions it as a scalable, high-yield stablecoin. By enabling cross-chain interoperability, attracting institutional investors, and enhancing DeFi use case, USDX will be a foundation in Flare’s ecosystem.

Works cited

“Peg Arbitrage Mechanism | Usdx.money.” Usdx.money, 14 Jan. 2025, docs.usdx.money/a-synthetic-usd/peg-arbitrage-mechanism. Accessed 13 Apr. 2025.

“Collateral | Flare Developer Hub.” Flare.network, 2025, dev.flare.network/fassets/collateral. Accessed 11 Apr. 2025.