Terra 6: Time's up, Go Time

With the burning of assets end of this month, there is no time for chain upgrades prior anymore

I previously announced there would be no new blog post until the Tax2Gas governance proposal goes live. In wake of alternative on chain tax ideas, announced by the same parties we can infer Tax2Gas was over our heads, and, for now, disregarded.

After months of waiting for the Tax2Gas implementation to take place, the chain will have no choice but to move on without; for fear of missing an easing of central banks and alt coin season, a point in the cycle where Bitcoin market dominance loses it’s impact on the rest of the market and mass liquidity enters. Measures taken to re-peg UST by re-activating the market making module with LUNC take precedent right now. The chain needs to be ready for the incoming liquidity of an alt season. Reiterating my past blogs, an investors perspective should focus on Terra in three parts, in order: mass stake LUNC, discount opportunity on UST, and finally the mass burn of LUNC.

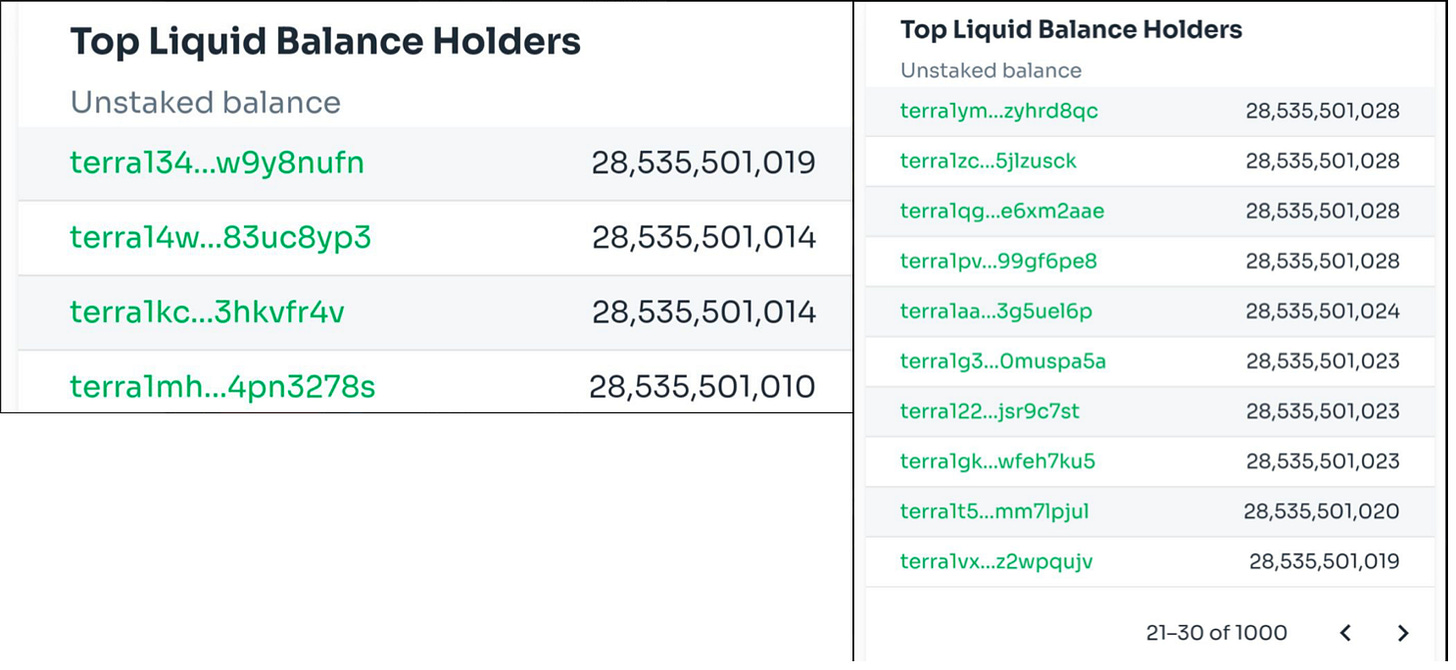

Consider chain security when such measures of a re-peg come to play. Security must be a priority. It is important to follow increasing staking supply. Network security= staked supply to validators. 14 un-staked wallets were created in 2022 before staking re-started and have stop accumulating this past May, 2024. Totaling 400b. Why are they un-staked? If we see these move, we will consider the mass stake event being triggered.

https://terraclassic.stakebin.io/terra/wallets

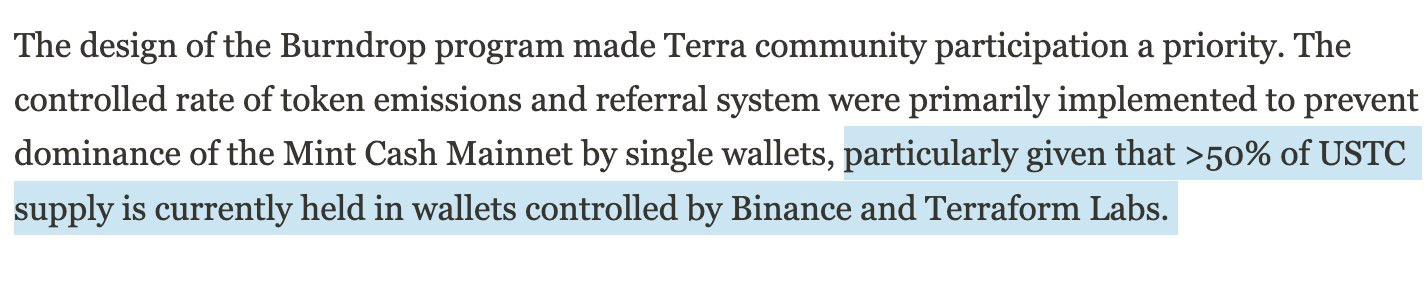

UST must be re-pegged in order to clear bad debt. Trading around 0.02c there is a 50x opportunity to speculate it reaching $1 again. A third party “Mint Cash” comprised of former Terra developers compiled data when carrying out a test on their own product. They released info that >50% USTC supply is held/controlled by Binance and Terraform Labs.

https://burndrop-docs.mintca.sh/

Simultaneously, in Terraform Lab’s bankruptcy case they have concluded they will be burning their holdings of UST and LUNC. This will marginally effect reduction of outstanding supply until MCAP=OUTSTANDING and reach $1. Much retail will approach the discount opportunity further closing the gap to $1. At this time LUNC market cap must be monitored. For the reserve must be held at a higher market cap than it’s stable coin counter part.

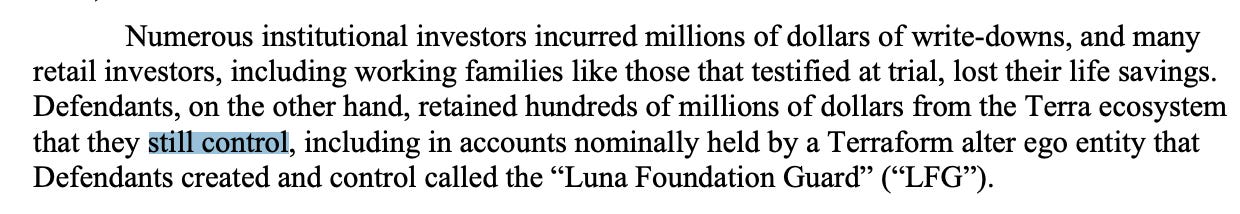

It is important to consider the mechanics of the market making mechanism between the two products and the necessity to keep LUNC market cap higher than UST. An easy assessment can be concluded Terraform along with creditors will be burning a significant amount of supply. Lawyers for the SEC stood by their proposed fine amount (around 4b) as a “conservative measure,” noting that the defendants “still control” hundreds of millions of dollars from TFL ecosystem and LunaFoundationGuard.

https://storage.courtlistener.com/recap/gov.uscourts.nysd.594150/gov.uscourts.nysd.594150.272.0.pdf

We can gather their LUNC holdings are comparable with their USTC holdings. In order to keep the reserve supply market cap higher than the stable coin market cap a viable option would be to burn LUNC supply incrementally, as early as end of this October. Thus, LUNC can be considered a tradable opportunity after re-peg of USTC.

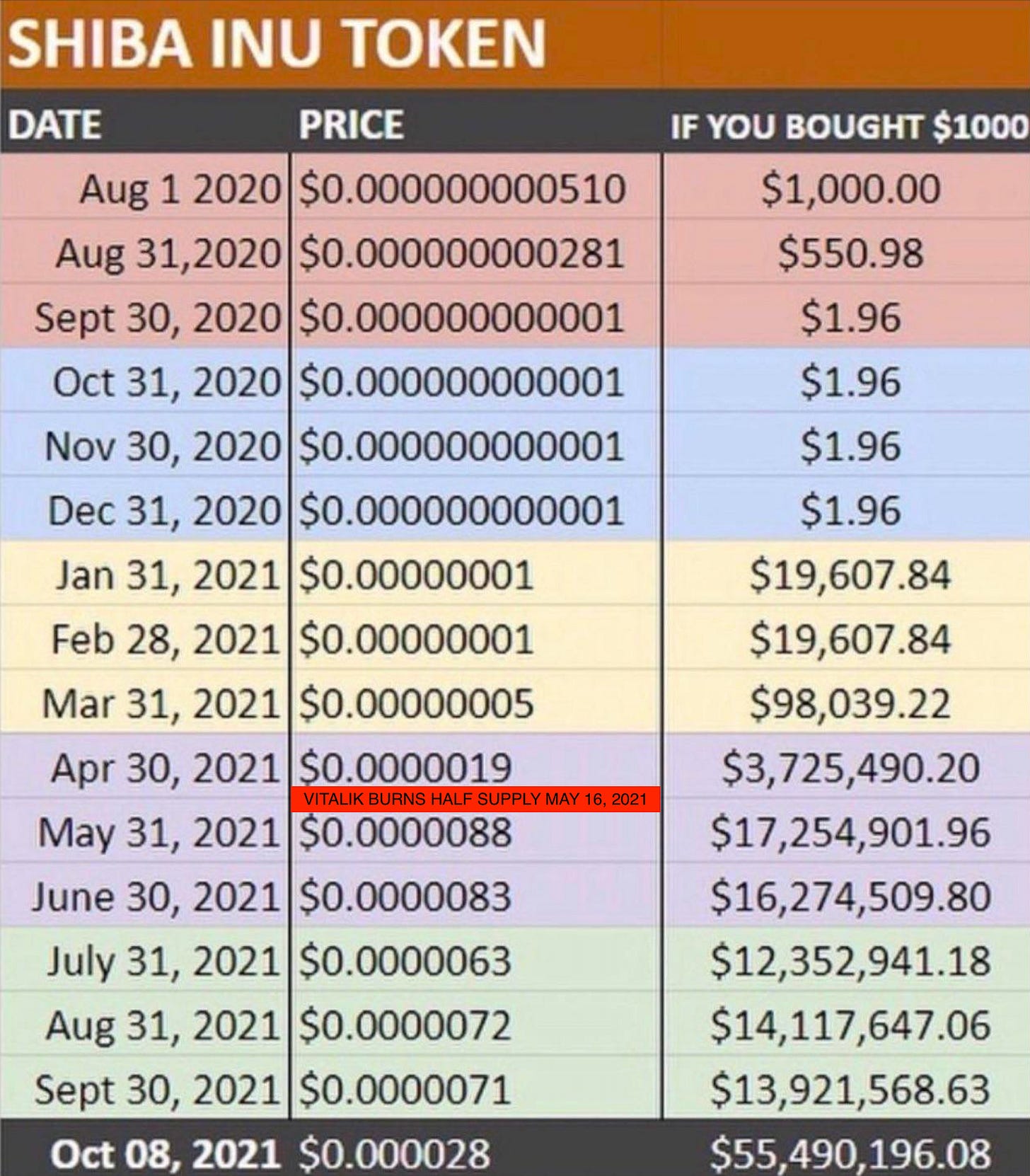

Consider Ethereum founder, Vitalik Buterin. In May 2021 he burned about 40-50% of Shiba Inu coin supply. This fostered a wave of demand for the chain. https://etherscan.io/tx/0x125714bb4db48757007fff2671b37637bbfd6d47b3a4757ebbd0c5222984f905

Judge Rakoff of US southern district of NY signed off on allowing burning of supply. There is legal court approval to do the same maneuver as Vitalik did in 2021, involuntarily creating demand for the coin, as did Shiba in 2021. We can use the same concept on LUNC, comparable with an even higher percentage outstanding, ready to be burned.