Terra 7: Recovery, then ATH

Macro is looking presentable

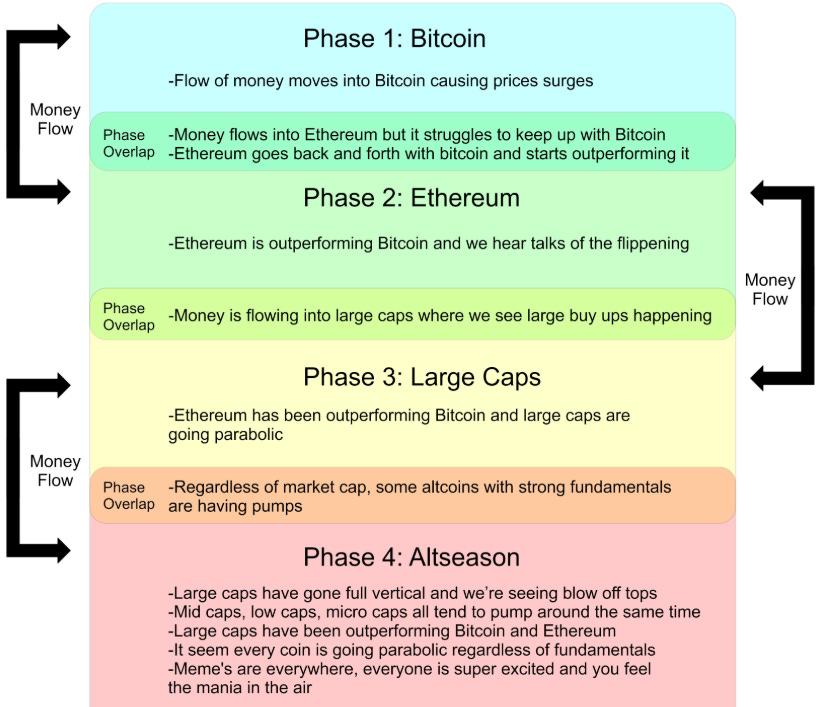

In the crypto industry, products don’t ship unless the market has sufficient liquidity. Why waste the effort for no reward? When investing in low market cap tokens, understand the order of liquidity. Timing is important. Right now we see BNB and SOL beginning to take ETH market share; we can interpret that as moving from Phase 2 to Phase 3 of the cycle.

My audience should be prepping for Phase 4. Let’s talk about Terra. There is a lot of mess that need to be cleaned up. There should be two orders of operations: a recovery, then a run.

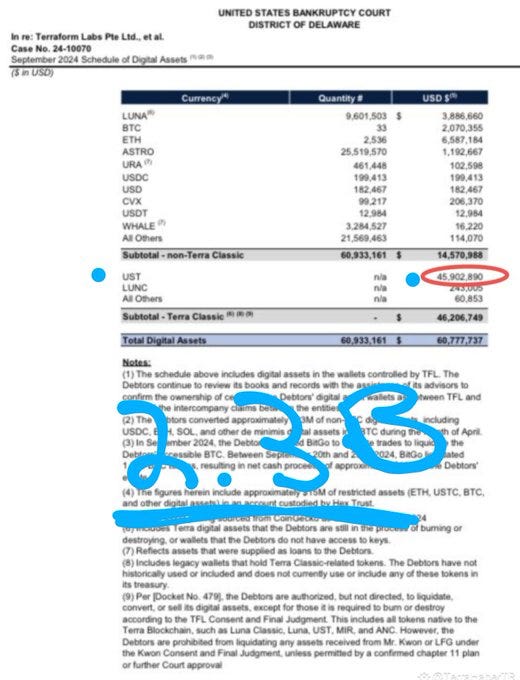

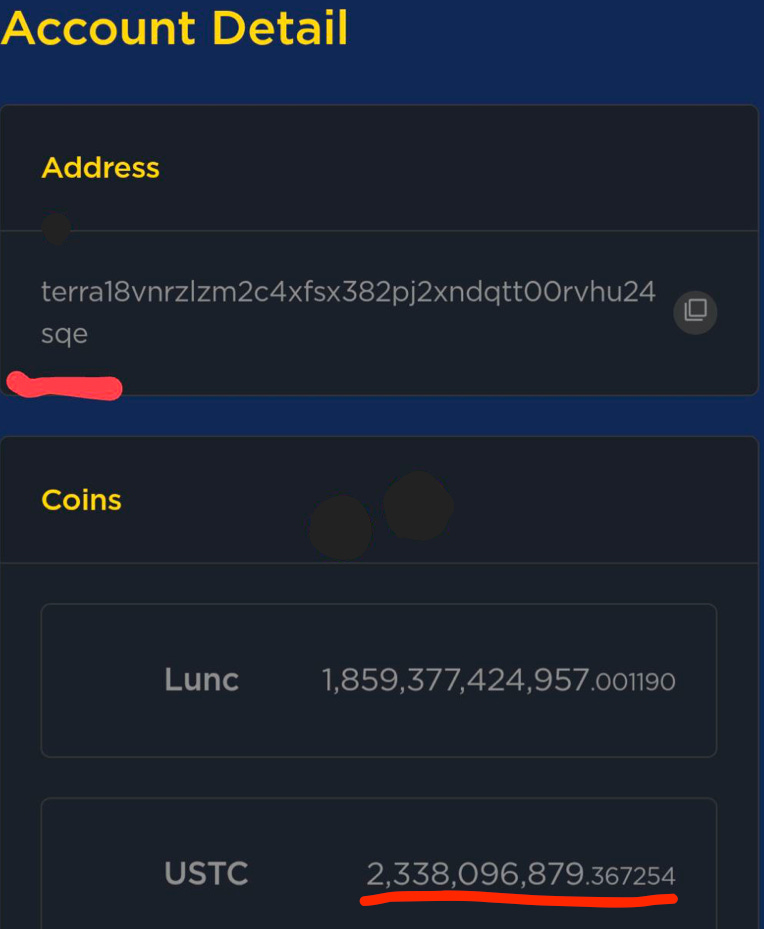

Phase 1: There are roughly 6b USTC outstanding, with a decent amount taken out of supply from the Luna Foundation Guard burn. The court still has Terraform Labs ordered to burn their balance sheet; I estimate 2.3b USTC there. Binance has 2.3b USTC stored on their wallet. This combined is nearly the entire supply.

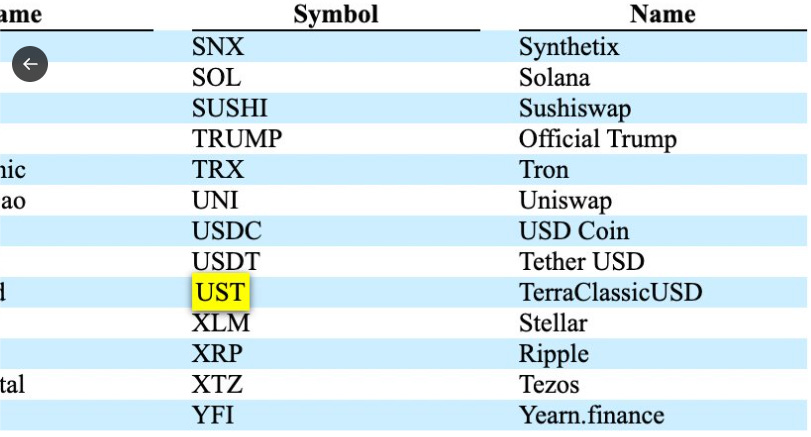

USD1, created by World Liberty Financial minted 2.1b supply in just 2 weeks on Binance Smart Chain and then stopped there. WLFI will go to market on September 1st. They have raised funds through ALT5, a prime service allowing users to buy and sell various cryptocurrencies, facilitating mainly over-the-counter transactions. ALT5 has purchased 1.5B WLFI tokens, noting a strong connection between the two, lead by Eric Trump. On their SEC filing, USTC is explicitly listed in their treasury. Why would they hold a debt-encumbered product?

Could WLFI in theory prop the amount of USTC Binance holds? Maybe what we saw similar to the Mint Cash experiment while TFL moves forward with the court order, burning their assets. Understand this is highly speculative.

It is important that LUNC sustains a higher market cap, as the reserve of the product must be more valuable.

Phase 2:

What was wrong with the initial Terra product? It was vulnerable to an attack. A large swap took place between UST and USDC in a single liquidity pool; the illiquidity depegged UST. A George Soros-style attack, as we saw on the British pound years ago. Shorts printed profits.

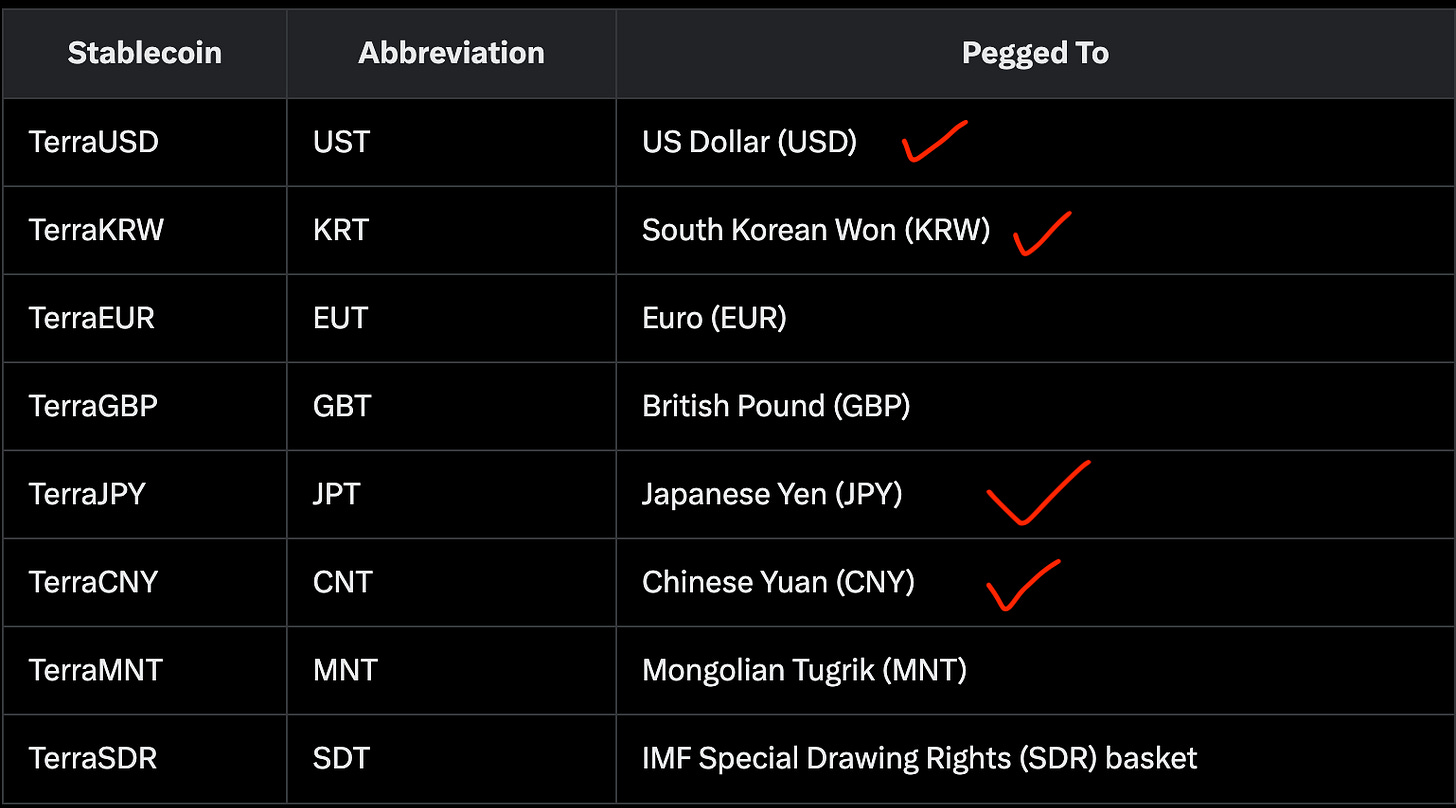

Stable coin competition is growing on-chain. Nations are beginning to compete with one another. Japan, South Korea, and China are all currently speed running regulation to enter the market and print new stable coins this Fall. Terra can be set up much more robustly. An attacker would have to target several. The time on arbitrage will have narrowed significantly then. I’m not sure CZ, head of Binance has referred back to this tweet yet, even as his own BNB coin hit new ATH numerous times. No other coins besides LUNC and BNB does Binance burn supply in trading fees for.

Works Cited

https://www.sec.gov/Archives/edgar/data/862861/000164117225022915/form424b5.htm

https://cointelegraph.com/news/south-korea-won-stablecoin-bill-october-dollar-dependence

https://cointelegraph.com/news/china-considering-yuan-backed-stablecoins-global-currency-usage

https://cointelegraph.com/news/japan-approves-first-yen-stablecoin-jpyc